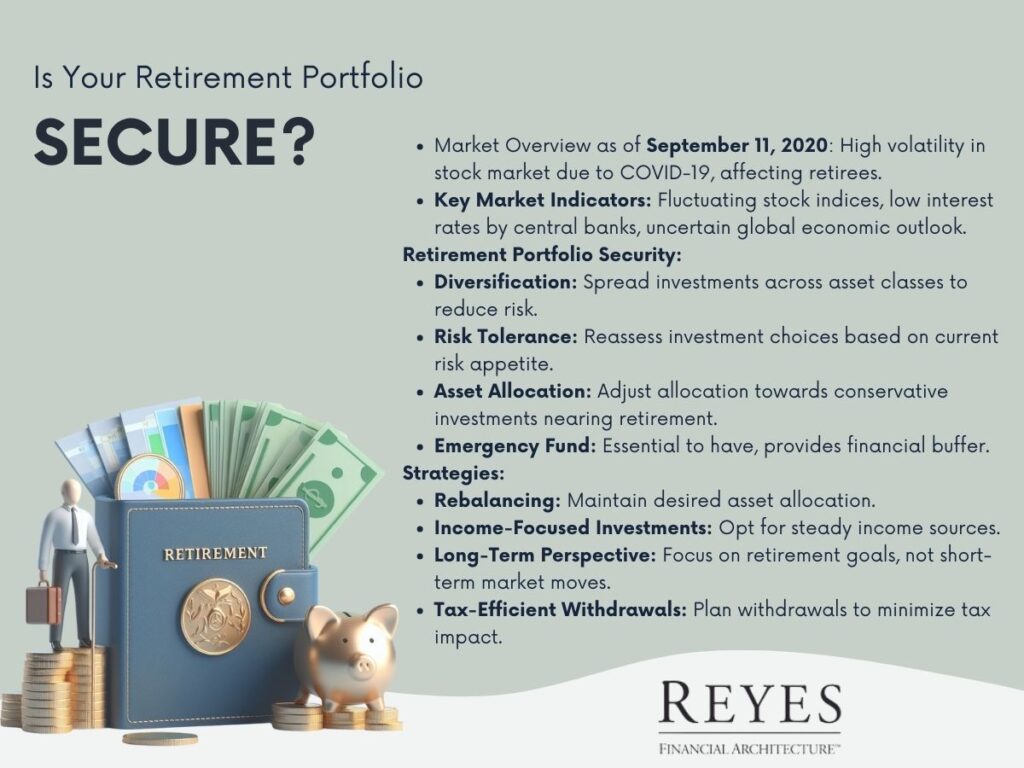

The financial markets are dynamic and ever-changing, and the events around September 11, 2020, have brought new challenges and uncertainties for retirees and those nearing retirement. With the COVID-19 pandemic continuing to impact economies globally, it's crucial to evaluate the security and resilience of your retirement portfolio. In this market update, we'll explore the current financial landscape and provide insights on securing your retirement investments.

The stock market has experienced significant volatility in 2020, largely due to the uncertainty surrounding the COVID-19 pandemic. This volatility poses a particular concern for retirees, who may not have the luxury of time to recover from substantial market downturns.

Diversification remains a key strategy in managing risk. Ensure your portfolio is spread across various asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate the impact of market volatility.

Your risk tolerance may have changed in response to the current market conditions and personal circumstances, such as nearing retirement. It’s crucial to reassess your investment choices to align with your current risk appetite.

Review your asset allocation to ensure it's in line with your retirement goals. As you approach or enter retirement, a shift towards more conservative investments might be advisable to protect your capital.

Having an emergency fund outside of your investment portfolio is essential. It provides a financial buffer without needing to liquidate investments at potentially low market values.

The market as of September 11, 2020, presents unique challenges for retirees. It's more important than ever to take a proactive approach in managing your retirement portfolio, considering the current economic landscape and your personal retirement goals. Regular consultation with a financial advisor can provide valuable guidance in navigating these uncertain times.