Check out David on KUSI-TV discussing reasons to avoid using credit cards this holiday season.

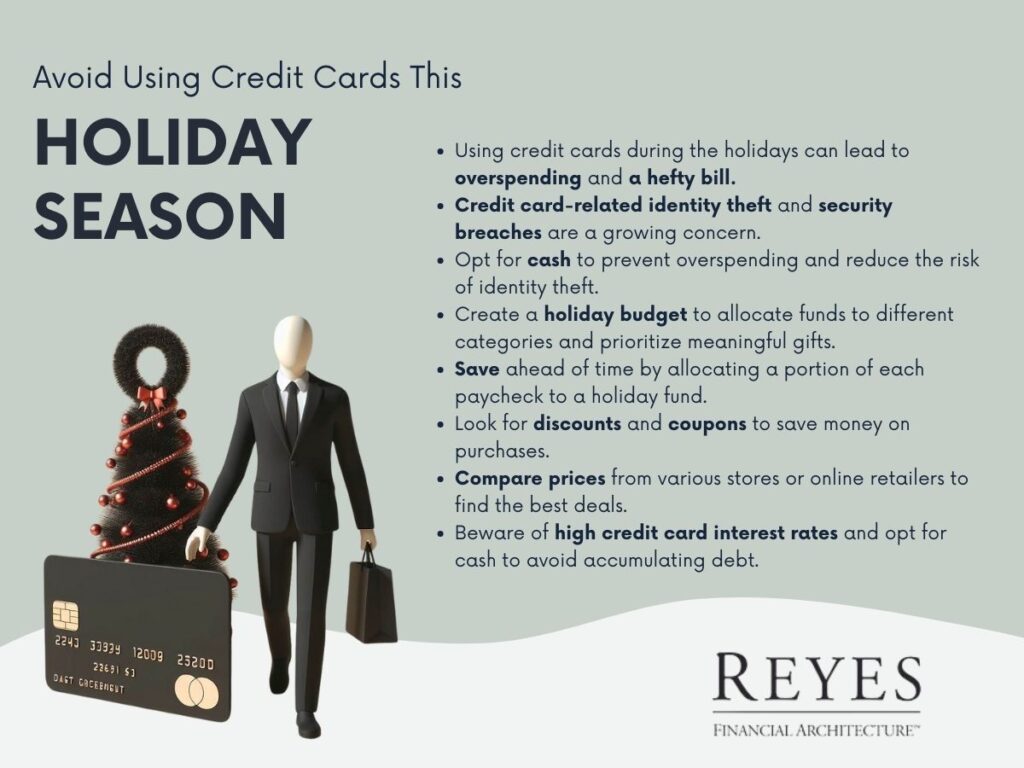

With the holiday season fast approaching, it's essential to take steps to prevent financial strain and excessive debt. Let's discuss some valuable reasons to steer clear of using credit cards during this festive period.

Consider the decision at the grocery store checkout, where you're asked, "paper or plastic?" In this scenario, cash can be likened to paper, and credit cards to plastic.

"Cash is always king," as it is akin to environmentally-friendly paper bags and can also be friendlier to your wallet. Let's explore the rationale behind prioritizing cash for holiday spending.

Using credit cards during the holidays can lead to overspending. It's easy to lose track of your expenses when using plastic, resulting in a substantial bill by the end of the season.

Credit card-related identity theft and security breaches are a growing concern. Recent incidents involving major credit card companies have exposed countless individuals to risk. For example, one prominent credit card issuer had over a hundred breaches in a single month, and over the past decade, more than ten billion records have been compromised.

Apart from opting for cash, consider establishing a holiday budget. Start by determining the total amount you're willing to spend and then allocate funds to different categories, prioritizing your loved ones. This method helps you avoid overspending on less essential gifts while ensuring that your nearest and dearest receive meaningful presents.

With the holiday season only a few weeks away, consider allocating a portion of each paycheck to create a holiday fund. Treating your paychecks as "layaway" for yourself ensures you'll have the necessary funds when it's time for your holiday shopping.

Here are some additional tips to consider:

1. Look for Coupons: Seek out discounts and coupons to save money on your purchases. Many retailers offer special deals during the holiday season, providing opportunities for savings.

2. Shop Around: Don't settle for the first price you encounter. Compare prices and explore various stores or online retailers to find the best deals.

3. Beware of Credit Card Interest: Credit card interest rates can be exceedingly high, often exceeding 20-25%. Avoid the allure of credit card offers and choose cash to prevent accumulating substantial interest charges.

4. Black Friday Opportunities: Black Friday and Cyber Monday offer excellent chances to snag deals. However, always stick to your budget to ensure a financially responsible holiday season.

In conclusion, as the holiday season draws near, it's crucial to make prudent financial choices to prevent unnecessary debt. By opting for cash over credit cards, setting a budget, and following these money-saving tips, you can enjoy a financially secure and stress-free holiday season. Remember that cash is the safest choice for both your finances and your peace of mind.