https://youtu.be/IxpXlsmLAKY

Watch this educational video which offers important information on how to ensure a successful retirement by creating additional income streams now

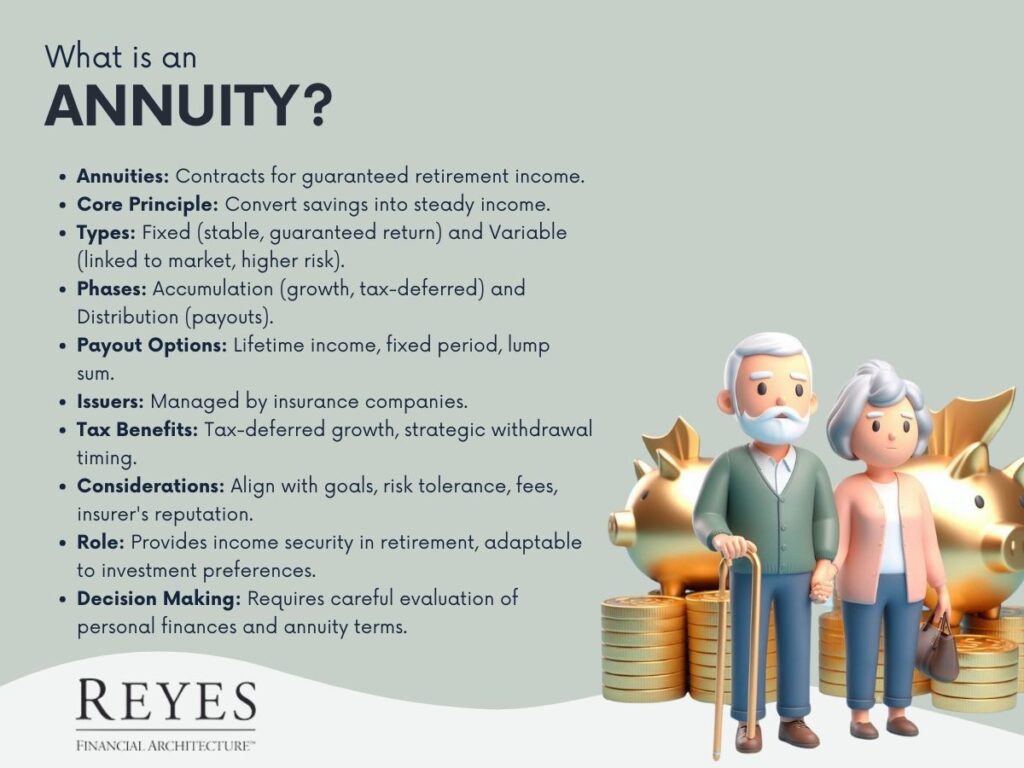

An annuity is a financial instrument primarily used for retirement planning, known for its ability to provide a guaranteed income stream. It's a contract between an individual and an insurance company designed to meet long-term retirement goals by offering a unique blend of income security and growth potential.

The fundamental appeal of annuities lies in their ability to convert accumulated savings into a steady income stream, which can be guaranteed for life or a specific period. This characteristic addresses one of the most significant concerns in retirement planning: the risk of outliving one's savings.

Insurance companies, which issue annuities, manage the funds contributed by individuals. They invest these funds to ensure they can meet the future income obligations. The guarantee of income is underpinned by the financial strength and management acumen of the insurance company.

One of the significant benefits of annuities is the tax-deferred growth of the invested funds. Taxes are only due when withdrawals are made, which can be strategically planned to fall in a period when the individual is potentially in a lower tax bracket, such as retirement.

Before investing in an annuity, it's crucial to consider:

Annuities stand out in the financial world for their ability to provide a guaranteed income, which is especially crucial in the retirement years. They offer various options to suit different investment profiles, from those seeking stability to others willing to embrace market risks for potentially higher returns. However, like any financial decision, investing in an annuity requires a careful evaluation of personal financial situations, goals, and the terms of the annuity contract. With the right choice, an annuity can be a cornerstone of a secure and stable retirement plan.