https://www.youtube.com/watch?v=8JUi3srJWs4&t=3s

Click on the link to watch the attached video to learn more about: What are RMD's and How are they Determined?

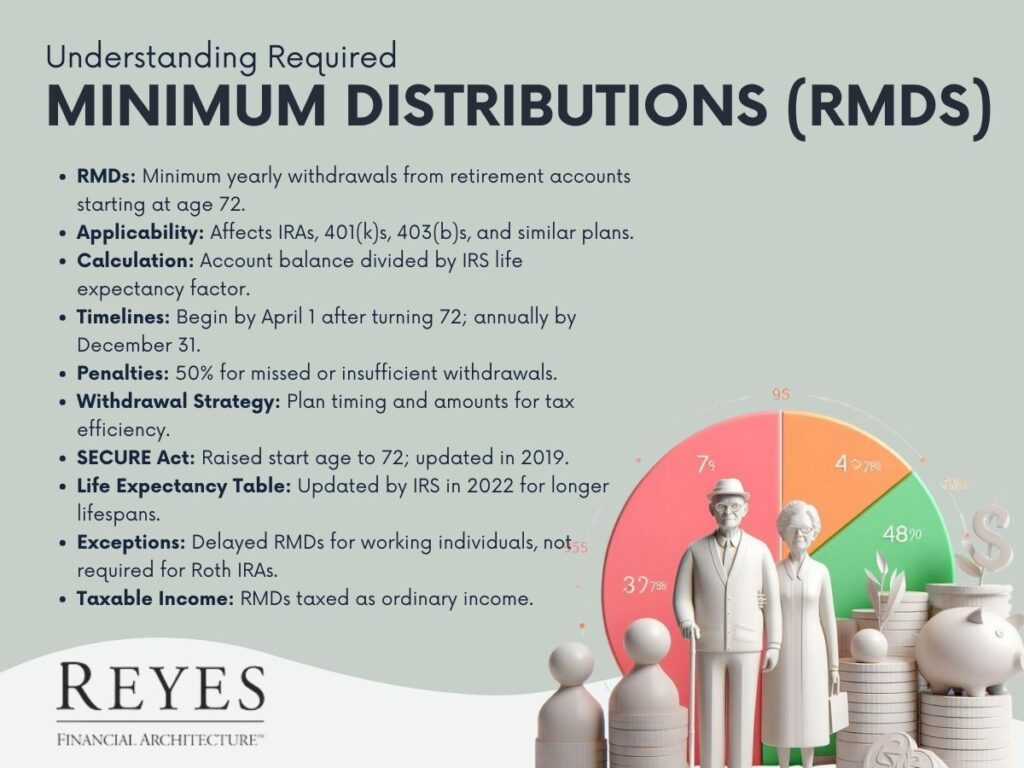

When it comes to retirement planning, understanding Required Minimum Distributions (RMDs) is crucial. Essentially, RMDs are the minimum amounts that a retirement plan account owner must withdraw annually, starting with the year they reach 70.5 years of age or, if later, the year they retire.

RMDs apply to tax-deferred retirement accounts. These accounts include IRAs, 401(k)s, 403(b)s, and other defined contribution plans. The rationale behind RMDs is straightforward: since contributions to these accounts are often tax-deductible, and the growth in the accounts is tax-deferred, RMDs ensure that this untaxed money is eventually subject to taxation.

The amount of an RMD is determined by dividing the account balance as of December 31 of the preceding year by a life expectancy factor set by the IRS. For example, at age 70, the life expectancy factor is 27.4 years. This means if a retiree has a retirement account balance of $100,000 at the end of the year, their RMD would be approximately $3,649 (100,000 divided by 27.4).

Understanding and planning for RMDs is a critical component of retirement planning. Failure to take an RMD, or withdrawing too little, can result in significant penalties – typically 50% of the amount that should have been withdrawn. Hence, it's essential for retirees to:

As of my last update in April 2023, there have been changes to the rules governing RMDs:

RMDs are taxable as ordinary income in the year they are withdrawn. Tax planning strategies, such as spreading out large expenses or deductions over several years, can help manage the tax burden associated with RMDs.

Required Minimum Distributions are a key aspect of retirement planning, especially for those with tax-deferred retirement accounts. Understanding how they are calculated, the timelines involved, and the strategies for managing them can have a significant impact on retirement income and taxation. With careful planning and, if necessary, professional advice, retirees can navigate RMDs effectively to optimize their retirement finances.

For a more personalized approach to RMDs and retirement strategy, consulting with a financial advisor is recommended. They can provide tailored advice and calculations based on individual circumstances, ensuring a comfortable and financially secure retirement.