https://www.youtube.com/watch?v=8JUi3srJWs4&t=3s

Click on the link to watch the attached video to learn more about: What are RMD's and How are they Determined?

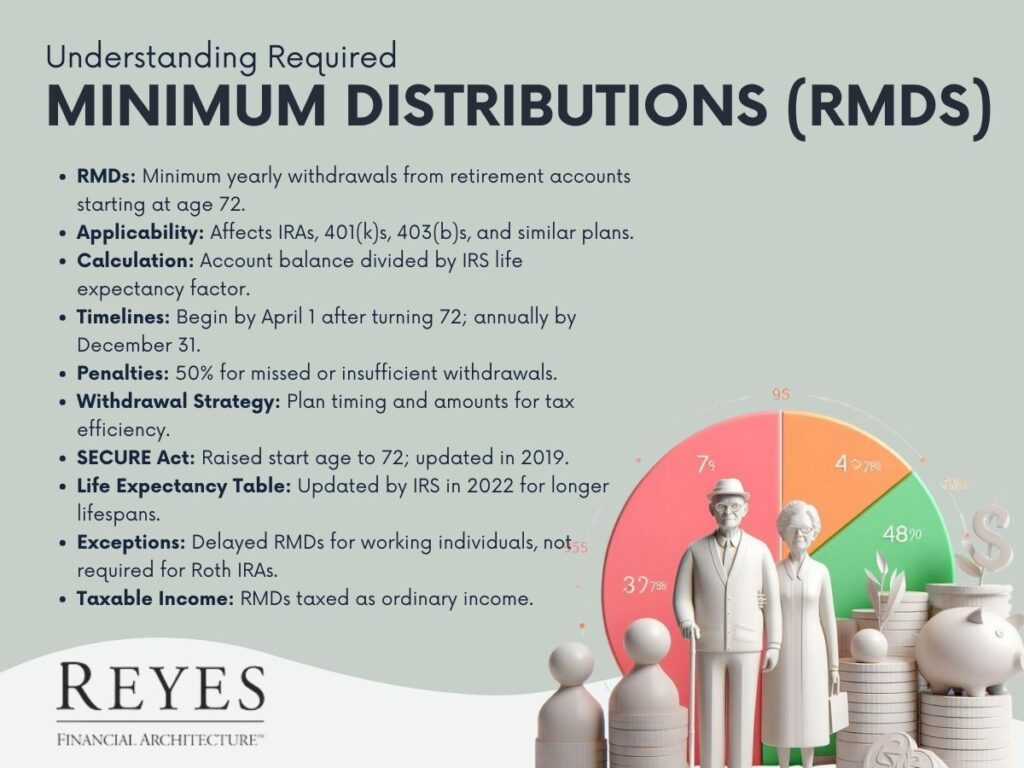

When it comes to retirement planning, understanding Required Minimum Distributions (RMDs) is crucial. Essentially, RMDs are the minimum amounts that a retirement plan account owner must withdraw annually, starting with the year they reach 70.5 years of age or, if later, the year they retire.

RMDs apply to tax-deferred retirement accounts. These accounts include IRAs, 401(k)s, 403(b)s, and other defined contribution plans. The rationale behind RMDs is straightforward: since contributions to these accounts are often tax-deductible, and the growth in the accounts is tax-deferred, RMDs ensure that this untaxed money is eventually subject to taxation.

The amount of an RMD is determined by dividing the account balance as of December 31 of the preceding year by a life expectancy factor set by the IRS. For example, at age 70, the life expectancy factor is 27.4 years. This means if a retiree has a retirement account balance of $100,000 at the end of the year, their RMD would be approximately $3,649 (100,000 divided by 27.4).

Understanding and planning for RMDs is a critical component of retirement planning. Failure to take an RMD, or withdrawing too little, can result in significant penalties – typically 50% of the amount that should have been withdrawn. Hence, it's essential for retirees to:

As of my last update in April 2023, there have been changes to the rules governing RMDs:

RMDs are taxable as ordinary income in the year they are withdrawn. Tax planning strategies, such as spreading out large expenses or deductions over several years, can help manage the tax burden associated with RMDs.

Required Minimum Distributions are a key aspect of retirement planning, especially for those with tax-deferred retirement accounts. Understanding how they are calculated, the timelines involved, and the strategies for managing them can have a significant impact on retirement income and taxation. With careful planning and, if necessary, professional advice, retirees can navigate RMDs effectively to optimize their retirement finances.

For a more personalized approach to RMDs and retirement strategy, consulting with a financial advisor is recommended. They can provide tailored advice and calculations based on individual circumstances, ensuring a comfortable and financially secure retirement.

Click on the link to watch our interactive video to quickly and simply understand: How to Strategize for your Social Security Benefits.

Social Security serves as a foundational element in many retirement plans, and understanding how to strategize for maximum benefits is crucial. With increasing life expectancies, retirement can last between 20 to 30 years, making Social Security planning more critical than ever. This blog explores the strategies for optimizing Social Security benefits, helping ensure a financially secure retirement.

The Social Security system in the United States is designed to provide financial support to individuals in their retirement years. The amount of benefit one receives is based on their 35 highest-earning years of work. The full retirement age (FRA) – the age at which one is eligible for full benefits – varies from 66 to 67, depending on the birth year.

The age at which you start claiming Social Security benefits significantly impacts the amount received. Claiming benefits at the earliest age of 62 results in a reduction of at least 25% compared to waiting until the full retirement age. Conversely, delaying benefits past the FRA up to age 70 leads to an increase in benefits, with a maximum increase of 32% at age 70.

For example, if the retirement income at age 66 is $2,000 per month, retiring at this age versus waiting until age 70 can mean a difference of over $200,000 over a lifetime. This stark difference underscores the importance of timing in Social Security planning.

Couples have additional strategies available. Spouses can claim benefits based on their work record or receive up to 50% of their spouse’s benefit at full retirement age, whichever is higher. Coordinating the timing of benefit claims can maximize total household Social Security income. For example, the lower-earning spouse might start benefits earlier, while the higher-earning spouse delays benefits to increase the survivor benefit.

Working while receiving Social Security benefits before reaching the full retirement age can temporarily reduce your benefits. Understanding these rules is vital for those planning to work part-time in retirement. After reaching the full retirement age, however, earnings do not affect Social Security benefits.

Up to 85% of Social Security benefits can be taxable, depending on your total income. Planning for tax implications is essential. Strategies like Roth IRA conversions or timing the withdrawal of retirement accounts can impact the taxation of Social Security benefits and overall retirement income.

Repositioning assets to reduce taxable income can lead to more tax-efficient retirement income. This might involve shifting from taxable accounts to Roth IRAs or employing tax-loss harvesting strategies. This repositioning can influence the taxation of Social Security benefits, potentially leading to lower overall tax liabilities.

With over 500 possible combinations of factors affecting benefits, consulting a financial advisor who specializes in Social Security planning is highly recommended. An advisor can offer customized strategies based on individual circumstances and help navigate the complex rules of the Social Security system.

Social Security planning should be a personalized process, reflecting individual work histories, health status, family circumstances, and retirement goals. The decision on when to claim benefits is a pivotal one, with long-lasting financial implications.

Understanding the nuances of the Social Security system and employing strategic planning can make a significant difference in retirement income, ensuring a more secure and comfortable retirement phase.

As retirements grow longer, the importance of maximizing Social Security benefits cannot be overstated. It's not just about when to start claiming benefits but how to integrate them with other retirement income sources, tax planning, and spousal benefits. Informed decisions and strategic planning in this arena are invaluable for achieving a financially stable and fulfilling retirement.