Watch this informative and interactive video to learn more about our services!

In the complex world of finance, selecting a qualified financial advisor is crucial for ensuring effective management of your financial assets. Financial industries, recognizing the need for establishing benchmarks of excellence, have developed various accreditation programs.

These programs serve as a beacon, guiding individuals in choosing competent financial advisors equipped with the necessary skills and knowledge. Below is an overview of some prominent designations you should consider when selecting a financial advisor.

The Certified Financial Planner (CFP) is among the most sought-after designations in financial planning. To earn the CFP title, candidates must excel in four core areas: Education, Examination, Experience, and Ethics.

This comprehensive approach ensures that CFP professionals are well-equipped to offer sound financial planning advice. They undergo rigorous academic training, covering a wide range of topics including retirement planning, estate planning, risk management, and tax planning.

The examination phase is exhaustive, testing their practical application skills and theoretical knowledge. Furthermore, they must accumulate substantial real-world experience before they can be certified. Finally, adherence to high ethical standards is mandatory, ensuring that a CFP acts in the best interest of their clients.

The Chartered Financial Consultant (ChFC) designation is similar to the CFP in many respects, particularly in the depth and breadth of financial knowledge required. However, one key difference is the absence of a comprehensive board examination in the ChFC certification process.

ChFC professionals specialize in all aspects of financial planning, including insurance, income taxation, retirement planning, investments, and estate planning. This designation is often pursued by professionals who wish to deepen their understanding of financial planning without undergoing the CFP’s rigorous examination process.

The Chartered Life Underwriter (CLU) is the premier designation for professionals specializing in life insurance and estate planning. Regarded as the most respected insurance designation, the CLU equips professionals with in-depth knowledge of various life insurance products and a comprehensive understanding of the legal, financial, and tax aspects of estate planning.

This designation is particularly valuable for individuals seeking expert guidance in life insurance and estate management.

A Certified Public Accountant (CPA) is a professional who has excelled in the realm of accounting. To attain the CPA designation, one must complete the required college courses, earn a bachelor’s degree, and pass a rigorous 19-hour examination spread over two days. CPAs specialize in various aspects of financial management, including taxes, auditing, and bookkeeping. Their expertise is particularly vital in navigating complex tax laws and ensuring accurate financial reporting and auditing.

The Chartered Financial Analyst (CFA) designation is highly coveted in the field of investment management. To become a CFA, candidates must undergo a demanding course of study and pass a series of challenging exams.

The focus of the CFA program is investment analysis and portfolio management. CFAs are renowned for their expertise in financial analysis, valuation, asset management, and the application of ethical and professional standards in investment management.

The financial industry is constantly evolving, leading to the emergence of new designations. While these new credentials may offer specialized knowledge in certain areas, it's important to note that not all are as rigorously tested as the CFP and CPA designations.

As the financial landscape becomes increasingly complex, these designations play a pivotal role in defining the standards of professionalism and competence.

Choosing a financial advisor with the right designation is a crucial step in ensuring that your financial needs are adequately addressed. Each designation signifies a different area of expertise and a different approach to financial management.

It's essential to select a professional who not only holds a relevant designation but also understands your unique financial situation and goals. Look for advisors who are committed to aligning their expertise with your specific needs.

When selecting a financial advisor, the array of designations can be overwhelming. However, understanding these key designations – CFP, ChFC, CLU, CPA, and CFA – can significantly aid in making an informed choice. Remember, the right financial advisor is not just about credentials; it's also about finding someone who can tailor their expertise to your individual needs.

Always inquire about their experience, their approach to financial planning, and how they intend to meet your specific requirements. With the right advisor, you can navigate the complexities of financial planning with confidence and clarity

.

Welcome, readers, to this insightful article on revolutionizing retirement planning. In today's discussion, we will explore key concepts from a recent book focusing on retirement preparation. Over a series of articles, we will delve into the core principles that aim to reshape how we approach retirement.

In 1995, one individual entered the financial advisory business with dreams of making a difference in the lives of retirees. Little did they know that a deeply personal experience would significantly impact their outlook on financial planning. This poignant story demonstrates the importance of comprehensive retirement planning.

Many individuals may find themselves lacking the necessary knowledge and resources to navigate retirement planning effectively. Traditional financial advisors often concentrate on asset allocation, presenting visually appealing charts that may not provide the best protection against capital loss during retirement.

During the 2008 financial crisis, many retirees discovered the limitations of traditional diversification strategies. Despite being told that a balanced portfolio of stocks and bonds was a conservative approach, they experienced substantial losses. These events highlighted the need for more robust retirement planning.

To address the shortcomings in retirement planning, a more comprehensive and integrated strategy is essential. This approach goes beyond traditional asset allocation and introduces the concept of a "retirement income distribution plan." This plan is designed to stress-test assets, minimize fees, and provide a customized roadmap for each individual's unique financial situation.

Diversification should extend beyond asset classes and encompass various investment strategies. For instance, real estate investments can provide stability since they often perform independently of the stock market. By incorporating such non-correlated assets into your portfolio, you can reduce vulnerability during market downturns.

Diversification alone may not be enough to protect your portfolio during market volatility. Implementing risk management strategies is crucial. One such strategy is a "stop loss" mechanism, which caps losses at a predetermined percentage. This approach acts as a safeguard against significant portfolio declines during turbulent market conditions.

In this article, we have explored innovative concepts in retirement planning that aim to improve financial security during one's retirement years. The emphasis has been on comprehensive, integrated planning that surpasses traditional asset allocation.

The goal is to protect against risk and enhance returns for a more secure financial future. Stay tuned for the upcoming articles in this series, where we will delve deeper into these innovative strategies.

https://www.youtube.com/watch?v=8JUi3srJWs4&t=3s

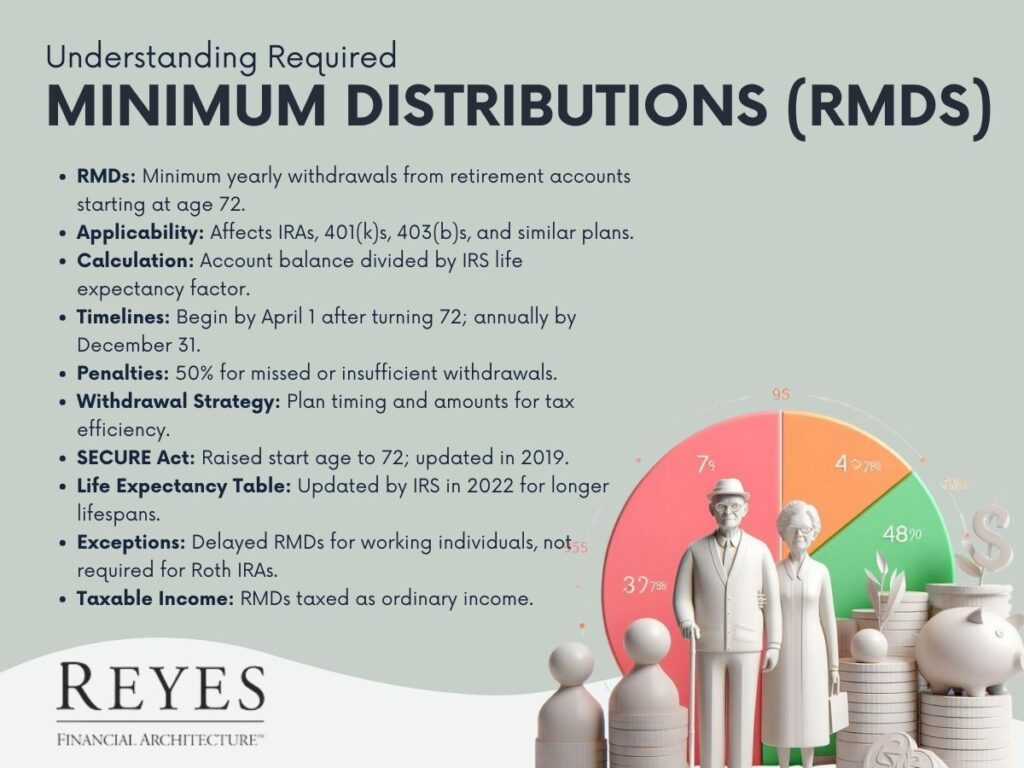

Click on the link to watch the attached video to learn more about: What are RMD's and How are they Determined?

When it comes to retirement planning, understanding Required Minimum Distributions (RMDs) is crucial. Essentially, RMDs are the minimum amounts that a retirement plan account owner must withdraw annually, starting with the year they reach 70.5 years of age or, if later, the year they retire.

RMDs apply to tax-deferred retirement accounts. These accounts include IRAs, 401(k)s, 403(b)s, and other defined contribution plans. The rationale behind RMDs is straightforward: since contributions to these accounts are often tax-deductible, and the growth in the accounts is tax-deferred, RMDs ensure that this untaxed money is eventually subject to taxation.

The amount of an RMD is determined by dividing the account balance as of December 31 of the preceding year by a life expectancy factor set by the IRS. For example, at age 70, the life expectancy factor is 27.4 years. This means if a retiree has a retirement account balance of $100,000 at the end of the year, their RMD would be approximately $3,649 (100,000 divided by 27.4).

Understanding and planning for RMDs is a critical component of retirement planning. Failure to take an RMD, or withdrawing too little, can result in significant penalties – typically 50% of the amount that should have been withdrawn. Hence, it's essential for retirees to:

As of my last update in April 2023, there have been changes to the rules governing RMDs:

RMDs are taxable as ordinary income in the year they are withdrawn. Tax planning strategies, such as spreading out large expenses or deductions over several years, can help manage the tax burden associated with RMDs.

Required Minimum Distributions are a key aspect of retirement planning, especially for those with tax-deferred retirement accounts. Understanding how they are calculated, the timelines involved, and the strategies for managing them can have a significant impact on retirement income and taxation. With careful planning and, if necessary, professional advice, retirees can navigate RMDs effectively to optimize their retirement finances.

For a more personalized approach to RMDs and retirement strategy, consulting with a financial advisor is recommended. They can provide tailored advice and calculations based on individual circumstances, ensuring a comfortable and financially secure retirement.

Click on the link to watch our interactive video to quickly and simply understand: How to Strategize for your Social Security Benefits.

Social Security serves as a foundational element in many retirement plans, and understanding how to strategize for maximum benefits is crucial. With increasing life expectancies, retirement can last between 20 to 30 years, making Social Security planning more critical than ever. This blog explores the strategies for optimizing Social Security benefits, helping ensure a financially secure retirement.

The Social Security system in the United States is designed to provide financial support to individuals in their retirement years. The amount of benefit one receives is based on their 35 highest-earning years of work. The full retirement age (FRA) – the age at which one is eligible for full benefits – varies from 66 to 67, depending on the birth year.

The age at which you start claiming Social Security benefits significantly impacts the amount received. Claiming benefits at the earliest age of 62 results in a reduction of at least 25% compared to waiting until the full retirement age. Conversely, delaying benefits past the FRA up to age 70 leads to an increase in benefits, with a maximum increase of 32% at age 70.

For example, if the retirement income at age 66 is $2,000 per month, retiring at this age versus waiting until age 70 can mean a difference of over $200,000 over a lifetime. This stark difference underscores the importance of timing in Social Security planning.

Couples have additional strategies available. Spouses can claim benefits based on their work record or receive up to 50% of their spouse’s benefit at full retirement age, whichever is higher. Coordinating the timing of benefit claims can maximize total household Social Security income. For example, the lower-earning spouse might start benefits earlier, while the higher-earning spouse delays benefits to increase the survivor benefit.

Working while receiving Social Security benefits before reaching the full retirement age can temporarily reduce your benefits. Understanding these rules is vital for those planning to work part-time in retirement. After reaching the full retirement age, however, earnings do not affect Social Security benefits.

Up to 85% of Social Security benefits can be taxable, depending on your total income. Planning for tax implications is essential. Strategies like Roth IRA conversions or timing the withdrawal of retirement accounts can impact the taxation of Social Security benefits and overall retirement income.

Repositioning assets to reduce taxable income can lead to more tax-efficient retirement income. This might involve shifting from taxable accounts to Roth IRAs or employing tax-loss harvesting strategies. This repositioning can influence the taxation of Social Security benefits, potentially leading to lower overall tax liabilities.

With over 500 possible combinations of factors affecting benefits, consulting a financial advisor who specializes in Social Security planning is highly recommended. An advisor can offer customized strategies based on individual circumstances and help navigate the complex rules of the Social Security system.

Social Security planning should be a personalized process, reflecting individual work histories, health status, family circumstances, and retirement goals. The decision on when to claim benefits is a pivotal one, with long-lasting financial implications.

Understanding the nuances of the Social Security system and employing strategic planning can make a significant difference in retirement income, ensuring a more secure and comfortable retirement phase.

As retirements grow longer, the importance of maximizing Social Security benefits cannot be overstated. It's not just about when to start claiming benefits but how to integrate them with other retirement income sources, tax planning, and spousal benefits. Informed decisions and strategic planning in this arena are invaluable for achieving a financially stable and fulfilling retirement.