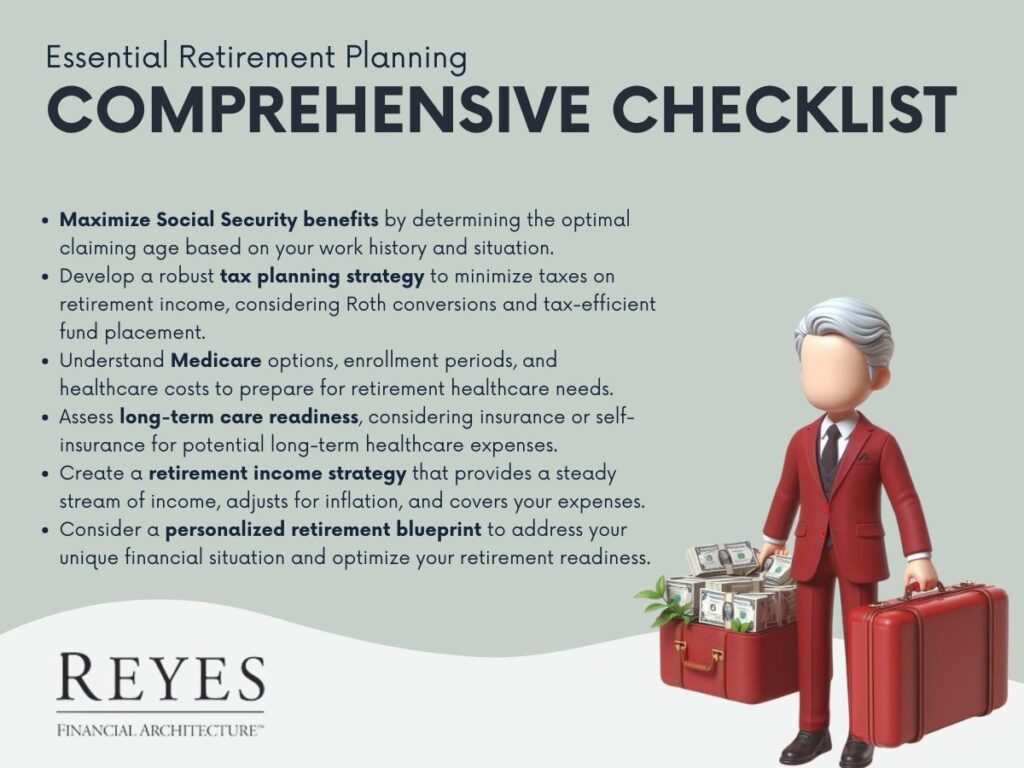

Welcome to the Finance Report. When it comes to navigating life's tasks, a checklist can provide clarity and direction — the same applies to planning for retirement. A well-crafted retirement strategy is akin to a checklist; it's a step-by-step guide to ensure you make the most of your golden years.

Tax planning is integral to a successful retirement as it can significantly impact your net income. With tax rates susceptible to change and inflation presenting an ongoing challenge, it's important to consider strategies such as Roth conversions, tax-efficient fund placement, and timed withdrawals.

For those who have diligently saved, there's a unique opportunity to receive professional assistance to craft a personalized retirement blueprint. This service is designed to layout a framework that addresses your current financial standings and the optimal routes to achieve retirement readiness.

If you're interested in developing a detailed retirement strategy, consider reaching out for a consultation. Having a financial roadmap in place is crucial. It will allow for a thorough analysis of your current situation and will enable an informed discussion on your best options moving forward.

Remember, every checklist item is an integral step towards a retirement that's as secure and enjoyable as possible. Take the time now to address each aspect, and put yourself on the path to a successful and fulfilling retirement. If you've reached that milestone of significant savings, seize this exclusive chance to work with financial planning professionals to help ensure your retirement years are spent with peace of mind and financial stability. Reach out now to start mapping your journey to a rewarding retirement.