Welcome to The Money Report. When we think of retirement expenses, we often consider basic needs like food, clothing, and healthcare. Yet, it might come as a surprise that for many, taxes could end up being the most significant retirement expense of all. With tax rates on the rise, crafting a strategy to mitigate these costs is more critical than ever.

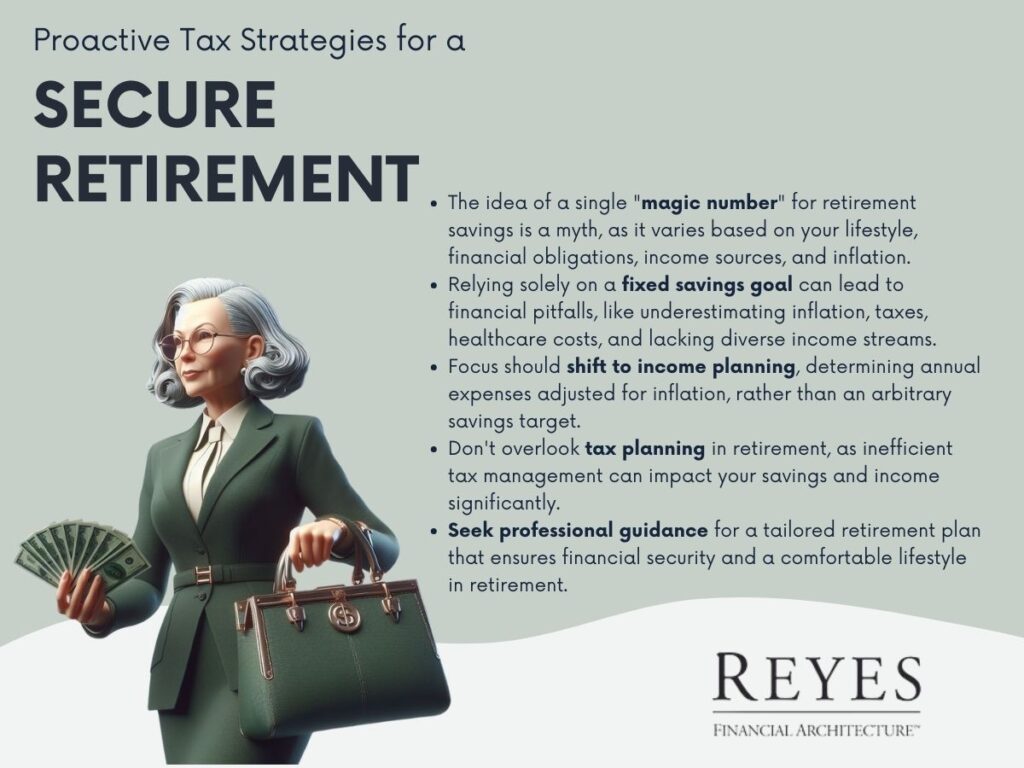

When it comes to retirement, proactive tax planning is essential. Without it, you could be facing tens or even hundreds of thousands of dollars in unnecessary tax liabilities. Between capital gains taxes on home sales and income tax on retirement distributions, the potential for overspending on taxes is substantial.

There are effective strategies to lower your tax burden:

Income planning is pivotal for retirement because it is essentially about replacing your work paycheck with other revenue streams—funds that need to last through your retirement years. A comprehensive income plan hinges on understanding your expected expenses, contemplating inflation adjustments, and considering the longevity of your portfolio.

For those within reach of retirement, particularly if you have a portfolio of significant value, there's the opportunity to receive personalized guidance through a complimentary retirement planning session. This planning includes an assessment of your current financial situation, a discussion of your financial goals, and the crafting of a tailored path to a secure retirement.

If you're eager to shore up your retirement planning, particularly with tax strategies to protect your nest egg, consider reaching out. There has never been a more critical time to ensure your financial affairs are in order, as a well-planned approach can make all the difference in how comfortably you can live in retirement.

Remember, retirement planning is not only about accumulating wealth—it's about making wise decisions on how to sustain and enjoy that wealth throughout your retirement years. Take the necessary steps now to put yourself in the best possible position for a successful retirement.

If you're ready to take action towards a tax-efficient, financially secure retirement, pick up the phone and get started today. With expert advice and a concrete retirement plan, you can confidently look forward to the future you've worked so hard to achieve.