Hello everyone, and it's great to touch base once again. We find ourselves halfway through what has turned out to be an incredibly challenging year, with enduring issues such as rampant inflation and the ongoing war in Ukraine impacting the global economy. We continue to observe the Federal Reserve's response to these challenges, particularly with the recent interest rate hikes which we'll delve deeper into.

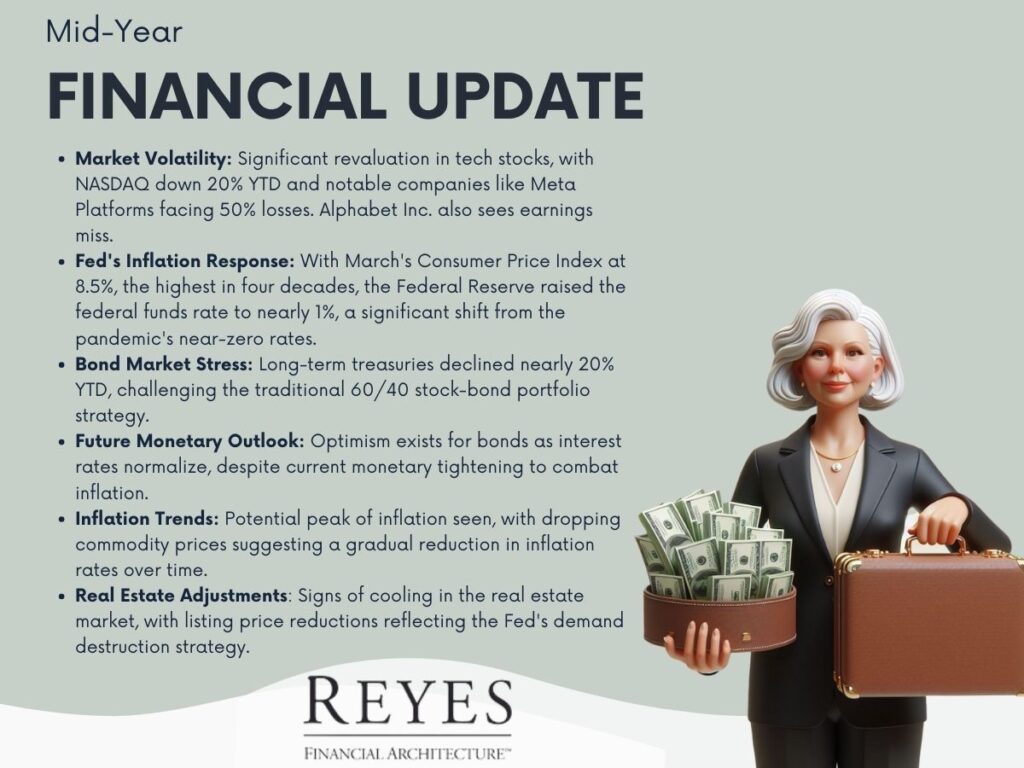

The technology sector, considered the backbone of many investment portfolios due to giants like Apple, Amazon, and Microsoft, is currently facing a reckoning. There's been a significant revaluation of tech stocks, contributing to a 20% decline in the NASDAQ year-to-date and staggering 50% losses in companies like Meta Platforms (formerly Facebook). Even Alphabet Inc. (Google's parent company) is feeling the sting, with its earnings miss likely leading to a further decline. Central to many of our current economic woes is the inflation surge, with the Consumer Price Index for March peaking at 8.5%—the highest in four decades. This inflationary pressure has prompted the Federal Reserve to take on a more hawkish stance, raising the federal funds rate to nearly 1%, with plans to push it even higher. This is a bold departure from almost zero percent interest rates which were set to stimulate the economy during the pandemic. The impact of these hikes is widespread, influencing everything from the cost of mortgages to the bond market. The traditional safe haven of bonds is undergoing a period of unprecedented stress. Long-term treasuries have seen declines close to 20% year-to-date. The typical 60/40 stock-bond portfolio, often considered a conservative approach, is underperforming significantly, further complicating investment strategies for many. Despite the current monetary tightening, there is optimism that as interest rates normalize, bonds may again become an attractive asset class. While timing the Federal Reserve's next moves can be tricky, there is a prevailing sentiment that they are committed to curbing inflation, a necessary step to bring the economy back to some semblance of equilibrium. Some analysts believe that we may have already witnessed the peak of inflation, with commodity prices for oil and copper showing significant recent drops. However, this doesn't imply an immediate return to lower consumer prices. It suggests we might see an incremental lowering of inflation rates, from the current highs down to more manageable levels over the next couple of years. In the real estate market, some signs of cooling are finally emerging, with reductions in listing prices starting to crop up. This adjustment is another area where the Federal Reserve's strategy of 'demand destruction' aims to temper inflation-driven growth. The looming question remains: are we in a recession, or is one imminent? Signs like an inverted yield curve and downward trending commodity prices suggest economic contraction. However, we should not fixate too much on the term 'recession'. Instead, we must consider what opportunities and strategies we can employ to navigate through or even benefit from these economic shifts.In wrapping up, let's remember that every economic cycle—no matter how difficult—also brings opportunities for strategic financial decisions. As we continue to monitor these developments, know that I'm here to discuss any questions or concerns you may have. We're dedicated to asset protection and making well-informed investment choices during these uncertain times. Please don't hesitate to reach out, and here's to making the second half of the year as productive as possibleA Recap of Market Volatility

The Fed's Tackling of Inflation

The Bond Market's Trials

The Future Monetary Landscape

Signs of Easing Inflation

Real Estate Market Adjustments

Navigating Through Recession Concerns