In the realm of financial planning and investment, a distinguishing factor among firms is the approach they take towards portfolio construction and risk management. This blog post delves into the intricacies of building a diverse and robust investment portfolio, moving beyond the traditional mix of stocks and bonds.

It draws on insights from a financial advisor who advocates for an approach similar to that used by large endowments like Yale University's. This method involves incorporating alternative investments, such as real estate, to achieve better risk-adjusted returns.

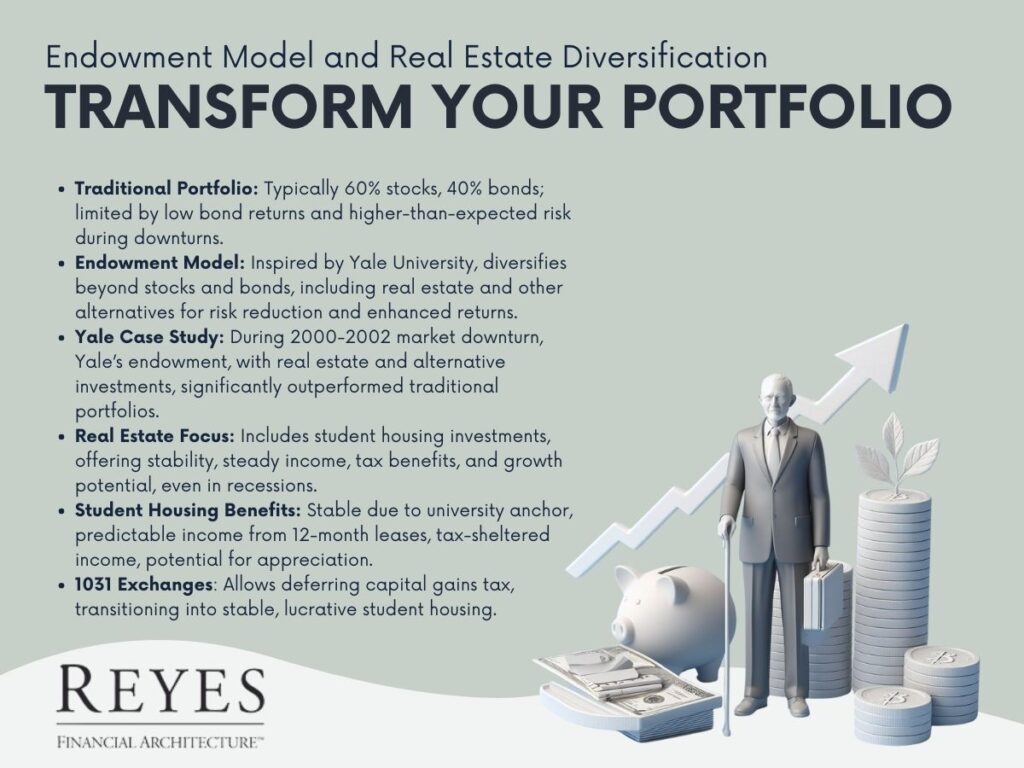

Traditionally, most investment portfolios comprise a mix of stocks and bonds. A common allocation might be 60% stocks and 40% bonds. However, this structure has its limitations. For the past decade, bonds have yielded minimal returns, dragging down overall portfolio performance.

Moreover, this traditional mix is not as low-risk as often perceived. During market downturns, such as the 2008 financial crisis, balanced portfolios of stocks and bonds still experienced significant losses. For instance, in 2008, an average stock fund lost about 30%, and a balanced portfolio saw losses around 30% at the lowest point.

The endowment model, pioneered by institutions like Yale University, offers a different approach. This model diversifies beyond stocks and bonds, including assets like real estate and other alternative investments. The rationale behind this strategy is not just risk reduction but also enhancement of returns over time.

Real estate plays a significant role in this diversified approach. It's not just about having a tangible asset but also about generating steady cash flow, gaining tax benefits, and potential appreciation.

A focus on student housing, managed by firms like NV Private Capital, further exemplifies this strategy. These properties, anchored by major universities, offer stability, income, and growth, often performing well even during recessions.

Investors holding traditional real estate can consider 1031 exchanges to transition into student housing investments. This allows them to defer capital gains taxes while moving into a potentially more stable and lucrative investment vehicle.

The financial industry often presents a conventional approach to portfolio construction, focusing heavily on stocks and bonds. However, this traditional mix may not be as secure or profitable as once thought, especially in volatile markets.

By adopting strategies used by successful endowments, like diversifying into real estate and other alternative assets, investors can potentially achieve better risk-adjusted returns. This approach, while more complex, can offer greater stability, income, and growth potential, making it an attractive option for those looking to build a more resilient and profitable investment portfolio.